The VC Funding Party Is Over

The VC Funding Party Is Over

For years, startups have enjoyed a boom in venture capital funding, with billions of dollars being poured into promising new ventures every year. However,…

The VC Funding Party Is Over

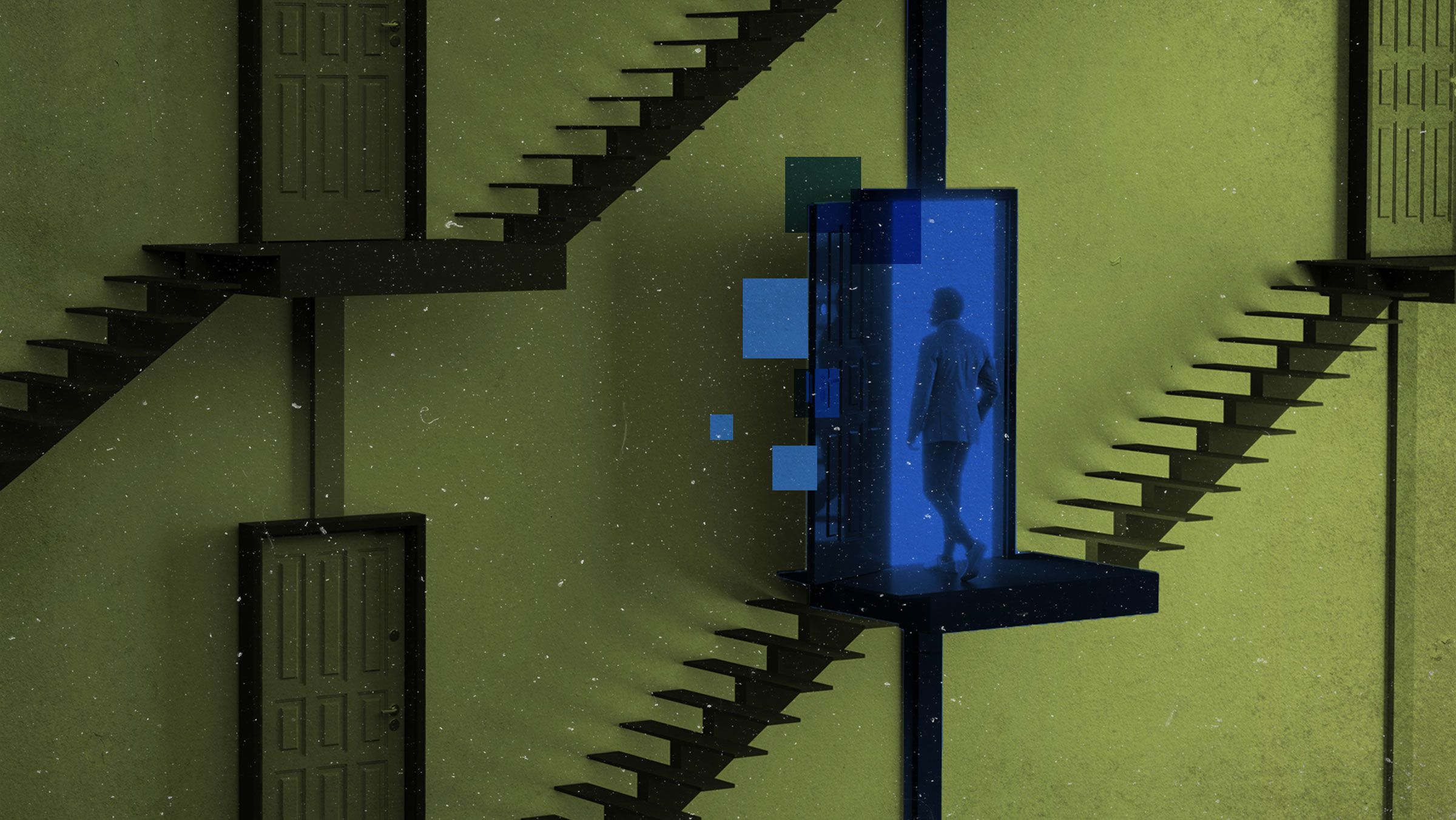

For years, startups have enjoyed a boom in venture capital funding, with billions of dollars being poured into promising new ventures every year. However, recent market corrections and economic uncertainties have signaled an end to this funding party.

Venture capitalists, once eager to invest in the next big thing, are now becoming more cautious and selective with their investments. This has left many startups struggling to secure the funding they need to grow and expand.

With funding becoming scarcer, startups are facing increased competition for investment dollars. Many are being forced to cut costs, pivot their business models, or even shut down altogether.

The days of easy money and sky-high valuations are coming to an end, as investors prioritize profitability and sustainable growth over rapid expansion at any cost.

Entrepreneurs must now focus on building solid, profitable businesses that can weather economic downturns and market fluctuations.

While the party may be over for some, this new era of cautious investing could lead to a healthier and more sustainable startup ecosystem in the long run.

Startups will need to adapt to this new reality, finding creative ways to attract funding and prove their long-term viability to investors.

As the VC funding environment continues to evolve, only the strongest and most resilient startups will survive and thrive in this new era of uncertainty.

While the party may be over, the lessons learned from this funding boom will shape the future of entrepreneurship for years to come.